A Small Stock Dividend Is Defined as

Small stock dividends are generally defined as payouts of less than 20 to 25 of the current number of the companys outstanding shares. Small stock dividends defined as less than 20 Accounting policy is to reclassify from ACCT 5381 at Texas AM University Corpus Christi.

A stock dividend is considered a small stock dividend if the number of shares being issued is less than 25.

. More than 30 of the corporations issued stock. Less than 25 of the corporations issued stock. Small Stock Dividends vs.

Amazon NASDAQAMZN was a 7 stock in 1998 and Tesla NASDAQTSLA had a market valuation of just over 1 billion. A small stock dividend is defined as Select one. Imagine owning stock in a company where the price appreciates greatly you sell it and pay no tax on your profit.

For small stock dividends the key distinction is that. More than 30 of the corporations issued stock. Under Section 1202 the capital gains from qualified small businesses are exempt from federal taxes.

To its shareholders in the normal course of business is called a. More than 30 of the corporations issued stock. A stock dividend is one form of dividend in kind.

In effect a distribution of stock transfers part of. For small stock dividends the key distinction is that. How to Account for a Small.

Small stock dividends are generally defined as payouts of less than 20 to 25 of the current number of the companys outstanding shares. A 060 quarterly cash payment paid by TL. A company issues dividends in the form of stock instead of cash.

For small stock dividends the key distinction is that. In addition the par value per stock is 1 and the market value is 10 on the declaration date. Accounting questions and answers.

A small stock dividend is defined as. Less than 20-25 of the corporations issued stock. This issuance of the stock dividend is.

If a corporation issues less than 25 percent of the total amount of the number of previously outstanding shares as a dividend this is considered a small stock dividend. This issuance of the stock dividend is called a small stock dividend. If the issuance is for a greater proportion of the previously outstanding shares then treat the transaction as a stock split.

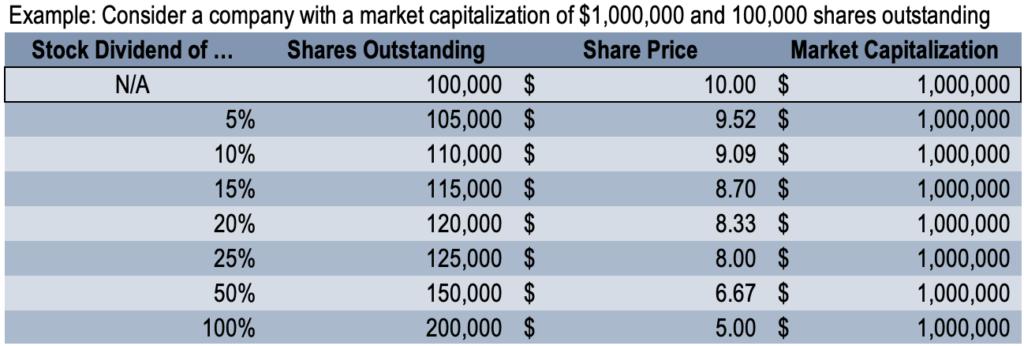

A company usually issues a stock dividend when it does not have the cash available to issue a normal cash dividend but still wants to give the appearance of having issued a payment to investors. Less than 30 but greater than 25 of the corporations issued stock. A large stock dividend generally over the 20-25 range is accounted for at par value.

A small stock dividend is distribution of 25 percent or less outstanding company shares to existing stockholders. A stock dividend is the issuance by a corporation of its common stock to shareholders without any consideration. A firm selling new shares of stock on the open market.

A firm buying back existing shares of its stock on the open market. A stock dividend is considered small if the shares issued are less than 25 of the total value of shares outstanding before the dividend. Between 50 and 100 of the corporations issued stock.

A small stock dividend generally less than 20-25 of the existing shares outstanding is accounted for at market price on the date of declaration. Between 50 and 100 of the corporations issued stock. Less than 30 but greater than 25 of the corporations issued stock.

A company resorts to stock dividends when it faces cash issues. These shares are issued in proportion to the existing shares held by the shareholders. Small stock dividends are generally defined as payouts of less than 20 to 25 of the current number of the companys outstanding shares.

Stock dividends do not affect the shareholders ownership rights in the company. A decrease in the number of. 6 A small stock dividend is defined as one that is A Less than or equal to 40.

The market price per share is 20 on. A small stock dividend is defined as a. Qualified Small Business Stock.

Some of the best stocks to buy in the past 25 years started as small-cap stocks. D Less than 25. To illustrate assume that Childers Corporation had 1000000 shares of 1 par value stock outstanding.

C Less than or equal to 10. A qualified small business stock QSBS is any stock acquired from a QSB after Aug. The board of directors of Wilson Sporting Equipment met this afternoon and passed a resolution.

A journal entry for a. B Less than 40. What Is It and How to Use It.

On the other hand if the company issues stock dividends more than 20 to 25 of its total common stocks the par value is used to assign the value to the dividend. For example assume a company holds 5000 common shares outstanding and declares a 5 common stock dividend. Thats what can happen with qualified small business stock QSBS.

Ex-stock dividend is equal to the price of the dividend of the stock the only difference is the face that the dividend is actually paid to. An increase in the number of shares outstanding that does not affect owners equity. A dividend distribution of 25 percent or less outstanding company shares to existing stockholders is called small stock dividend In other words a small stock dividend is one that increases outstanding shares by less than 26 percent through issuing new shares to the existing shareholders based on their percentage of right in the business or corporation.

In other words its a stock dividend that increases outstanding shares by less than 26 by issuing new shares to current investors based on their ownership percentage.

Chapter14 Corporations Dividends Retained Earnings And Income Reporting Ppt Download

11 Corporations Organization Stock Transactions Dividends And Retained Earnings Learning Objectives 1 Discuss The Major Characteristics Of A Corporation Ppt Download

0 Response to "A Small Stock Dividend Is Defined as"

Post a Comment